Unlocking Business Growth: The Power of Monthly Strategic Financial Reviews with Your Virtual CFO

In the fast-paced world of small business ownership, it’s easy to get caught up in the daily grind; managing operations, chasing leads, and putting out fires. But as a leader, your biggest challenge isn’t just surviving the day; it’s steering the ship toward sustainable growth. That’s where a Monthly Strategic Financial Review comes in. As your Virtual CFO, we help entrepreneurs like you transform raw financial data into actionable insights that drive real decisions. This isn’t about spreadsheets and jargon; it’s about clarity, strategy, and results.

If you’re running a business with limited resources, you already know how overwhelming financial management can feel. Traditional accounting might tell you what happened last month, but it rarely explains why or what’s next. A Monthly Strategic Financial Review bridges that gap, providing a structured, forward-looking discussion that aligns your finances with your big-picture goals. In this post, I’ll break down what this service entails, why it’s essential for your business, and how it can help you spot opportunities and avoid pitfalls before they become problems.

Why Monthly Strategic Financial Reviews Matter for Growing Businesses

What Happens in a Typical Monthly Strategic Financial Review?

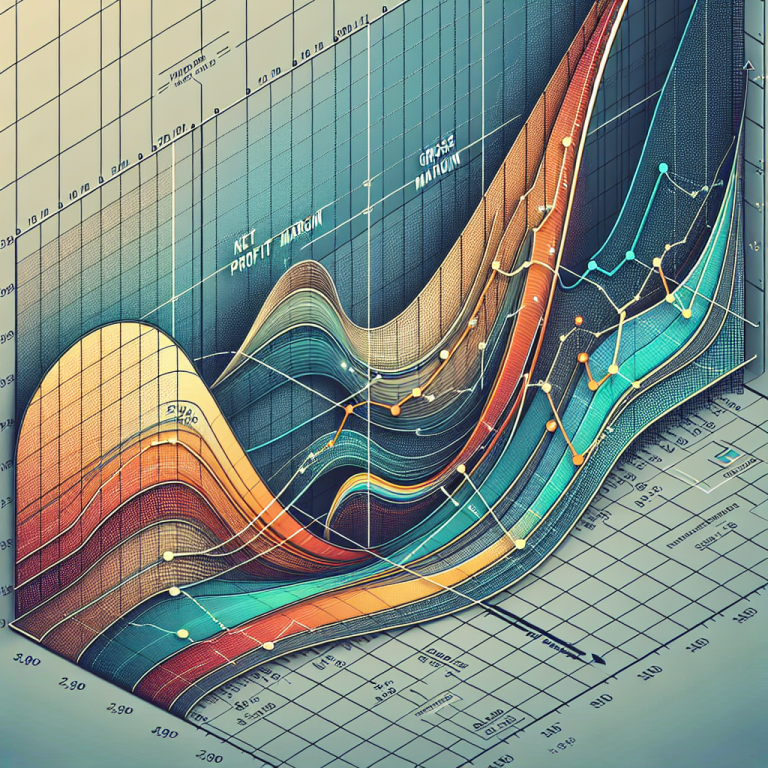

- Gross Margin: How efficiently are you turning sales into profit?

- Customer Acquisition Cost (CAC): Are you spending more to acquire customers than they’re worth?

- Inventory Turnover: For product-based businesses, this flags slow-moving stock.

- Burn Rate: Especially critical for startups or service firms scaling up.

- “Implement automated invoicing reminders by next week.”

- “Run A/B tests on pricing for Product X.”

- “Schedule a vendor negotiation call.”