Understanding the Revenue Factor in Business

In the world of business, understanding financial metrics is crucial. One such metric is the revenue factor. It plays a vital role in assessing a company’s financial health and efficiency.

The revenue factor helps businesses understand how effectively they generate income from operations. It is closely linked to profit margin and revenue streams.

A higher factor indicates better resource utilization. This can lead to increased income and improved financial performance.

Business owners, financial analysts, and entrepreneurs can benefit from understanding this metric. It aids in strategic planning and decision-making.

By exploring the factor, businesses can identify areas for improvement. This can lead to sustainable growth and resilience in changing market conditions.

What is revenue factor analysis?

Revenue factor analysis is a financial assessment method that measures how efficiently a business generates revenue from its available resources, such as labor or capital. By examining revenue factors, companies can identify areas to optimize performance, increase profitability, and drive sustainable growth.

Key Aspects:

- It helps assess financial health.

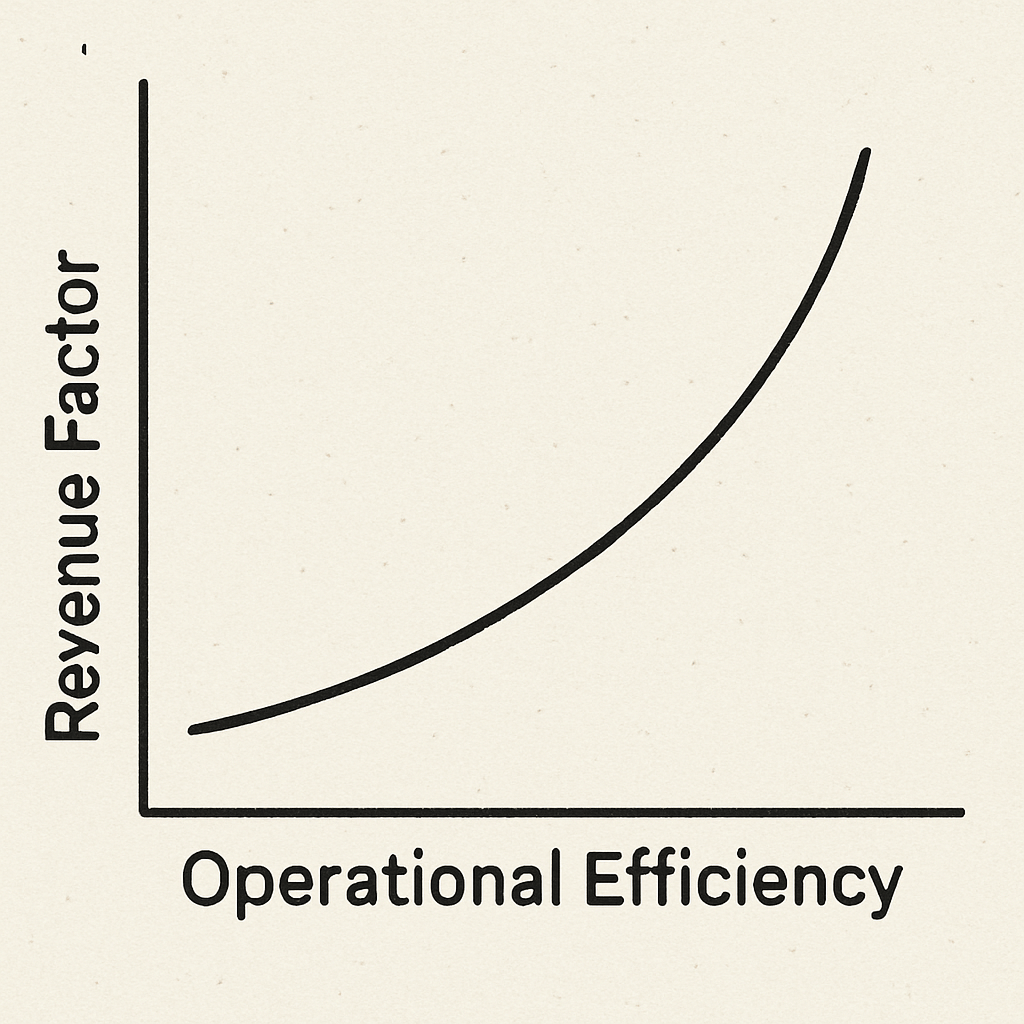

- Indicates operational efficiency.

- Relates closely to income generation.

This calculation provides insights into how well a business uses its resources to earn money. This metric is crucial for identifying strengths and weaknesses in operations. By examining the revenue factor, companies can make informed decisions to enhance productivity and profitability.

Overall, businesses aim to have a higher factor. This means they are maximizing resource utilization and improving their financial performance. Regularly analyzing this factor can lead to strategic adjustments that benefit the company’s bottom line.

How the Factor Relates to Profit Margin and Revenue Streams

The calculation is deeply connected to both profit margin and revenue streams. It provides a comprehensive picture of a company’s financial efficiency. While the factor focuses on income generation, the profit margin measures how much profit is earned from that income. Both metrics together reveal the financial performance of the business.

Revenue streams are the various sources from which a company earns money. Each stream contributes to the overall metric. Understanding these streams helps in analyzing which areas are most profitable.

Interrelations:

- Revenue Factor: Measures income efficiency.

- Profit Margin: Indicates profitability of income.

- Revenue Streams: Sources of income.

By analyzing these factors together, businesses can identify opportunities for growth. They can also determine areas where profitability can be improved. Understanding the interplay between revenue streams, profit margin, and the revenue factor enables strategic planning and informed decision-making. This integrated approach is essential for sustainable growth and robust financial performance.

Why it Matters in Financial Analysis

The metric is a crucial metric in financial analysis. It helps businesses gauge their financial health by reflecting how effectively they generate income. By tracking this metric, companies can better understand their income efficiency and identify potential areas for financial improvement.

A strong factor indicates good utilization of resources. It shows how well a company converts its operational efforts into income. Businesses that maintain a high revenue factor are often better positioned to achieve sustainable growth.

Benefits:

- Identifying trends in revenue generation

- Evaluating the impact of operational changes

- Forecasting future financial outcomes

In financial analysis, the metric helps in comparing performance against industry benchmarks. This comparison is essential for investors who assess profitability potential. Regular monitoring of the revenue factor can unveil trends and guide strategic decisions. Informed decisions driven by accurate analysis can lead to improved financial performance and increased profitability for the business.

Calculating the Revenue Factor: Step-by-Step Guide

Calculating the revenue factor is essential for comprehending a company’s income efficiency. This metric provides insights into how well a company utilizes its resources to generate revenue. By calculating this factor, businesses can better manage their financial performance and set strategic goals.

To determine the revenue factor, follow these steps:

- Identify the total revenue from all revenue streams.

- Measure the resources or expenses associated with generating this revenue.

- Divide the total revenue by the expenses to find the factor.

Example Calculation:

- Total Revenue: $500,000

- Total Expenses: $250,000

- Revenue Factor: $500,000 ÷ $250,000 = 2

A higher factor indicates efficient use of resources, which is vital for business growth. Regularly calculating this metric helps businesses evaluate the impact of strategic changes and improve operational efficiencies. It allows companies to identify areas where they can optimize operations to boost profitability.

Industry Benchmarks and Variations

Understanding industry benchmarks for this metric provides a broader context for evaluating financial performance. These benchmarks vary significantly across different sectors due to unique operational expenses and revenue streams. A company should compare its factor against these benchmarks to determine its competitive stance.

Variations are often influenced by a range of factors, including:

- Industry type and dynamics

- Company size and scale

- Market conditions and competition

- Operational efficiency levels

By comparing across similar businesses, a company can identify where it excels or lags. This comparison is crucial for strategic planning, allowing businesses to set realistic goals and enhance efficiency. Monitoring these variations helps in adapting strategies to stay competitive.

Strategies to Improve Your Revenue Factor

Enhancing your factor is essential for achieving sustainable growth. Businesses can adopt various strategies to boost their financial performance. A primary approach is optimizing operations to improve efficiency and reduce costs, thus increasing the profit margin.

Diversifying revenue streams also plays a significant role in enhancing the metric. This can involve exploring new markets or expanding product lines. By generating income from diverse sources, a company can stabilize and potentially increase its revenue factor.

Another effective strategy is to focus on customer retention and satisfaction. A satisfied customer base can lead to repeat business and referrals. Key strategies for improving your revenue factor include:

- Streamlining operational processes

- Exploring new business opportunities

- Enhancing customer engagement and loyalty

Investing in technology to improve productivity

Incorporating these strategies can lead to significant improvements in financial health, aligning the company for future success.

Common Mistakes and Misconceptions

It’s common to encounter mistakes when analyzing the revenue factor. A prevalent error is focusing solely on increasing revenue without considering costs, which can harm profit margins. Misunderstanding industry benchmarks is another issue. Common misconceptions include:

- Believing revenue growth alone improves financial health

- Ignoring the impact of overhead costs

- Overlooking the importance of diverse revenue streams

Conclusion: Leveraging the Revenue Factor for Business Growth

The revenue factor is crucial for steering your business toward success. It offers insight into operational efficiency and profitability. Utilizing this metric effectively allows businesses to optimize resources and maximize income.

By understanding and applying the revenue factor, companies can make informed decisions. This leads to sustained growth and improved financial performance.

It helps identify which business activities contribute most to revenue, uncovers inefficiencies, and guides data-driven improvements for higher profitability.

Revenue factor is typically calculated by dividing total revenue by a relevant business input, such as total labor hours, employee headcount, or another valuable resource.

Streamlining processes, investing in employee training, adjusting pricing strategies, and optimizing resource allocation can all improve your revenue factor.